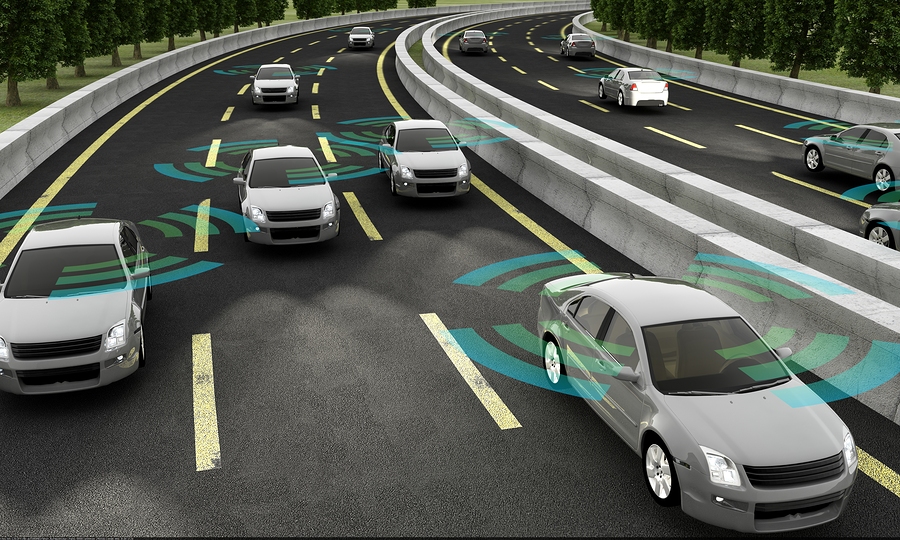

When it comes to driverless vehicles, one name used to come to mind: Tesla. But as others join the driverless race as it picks up speed toward a very different future on the road, these changes are disrupting vehicle manufacturing. What’s new in the self-driving space — and what further implications could it have on U.S. manufacturers?

Self-driving standards

Driverless vehicles have varying levels of automation, ranging from fully manual driving to complete automation. While level one vehicles may offer assistance such as speed control or collision avoidance, level two automation involves more advanced systems in the same general areas. Like those two, level three vehicles also require a driver behind the wheel but allow the vehicle to take on more safety functions. Levels four and five are much more highly automated as level four vehicles allow near-complete automation in mapped areas during good weather and level fives offer full automation always.

As manufacturers work to meet potential customers’ expectations, they implement new processes to achieve these levels of automation. And while the majority of manufacturers are looking at fully automating vehicles between 2020 and 2030, a couple players are coming out ahead. Tesla’s Elon Musk has sights set on the end of 2017 or beginning of 2018 for level five automation. With a long-held industry name in the driverless field and self-driving vehicles already on the roads, this small startup making big waves may not come as a surprise — but another company, rumored to be preparing to offer fully automated vehicles by 2018, is General Motors (GM).

GM

The folks at GM are no strangers to mass-manufacturing vehicles, but the company is one of the first to take the leap. Manufacturers in its Lake Orion, Michigan, plant completed 130 driverless Chevy Bolts and, while they’re designated as test vehicles, they put GM on a pedestal as “the only automaker capable of mass production of autonomous vehicles, putting it ahead of Tesla and other competitors.”

The folks at GM are no strangers to mass-manufacturing vehicles, but the company is one of the first to take the leap. Manufacturers in its Lake Orion, Michigan, plant completed 130 driverless Chevy Bolts and, while they’re designated as test vehicles, they put GM on a pedestal as “the only automaker capable of mass production of autonomous vehicles, putting it ahead of Tesla and other competitors.”

With the tools, workforce, and driverless technologies already at employees’ fingertips, GM, as the largest producer of vehicles in the world, could build its manufacturing workforce as these vehicles become more popular — and more affordable. With test vehicles now on the road, this new era could bring about a renaissance in vehicle manufacturing in the U.S.

New names

This revival may happen, in part, because of other big names — albeit those known mainly outside the vehicle manufacturing industry — also taking a stake in driverless vehicles. In fact, Uber partnered with Volvo and already has driverless vehicle pilot programs running, and Google is developing a self-driving vehicle with no steering wheel or break. Like Lyft partnering with GM, Apple is developing software for the driverless age, rather than producing a self-driving vehicle from the ground up.

With big names in software teaming up with auto manufacturers, electronics are likely to grow in importance in the industry. This could mean a boost to manufacturing jobs — but only if skilled professionals are available to support the increase.

As you shift your vehicle manufacturing plant to allow for these advances, know the professionals at Global Electronic Services are here for you. Contact us for all your industrial electronic, servo motor, AC and DC motor, hydraulic, and pneumatic repair needs. Want to join the conversation? Like and follow us on Facebook!

As you shift your vehicle manufacturing plant to allow for these advances, know the professionals at Global Electronic Services are here for you. Contact us for all your industrial electronic, servo motor, AC and DC motor, hydraulic, and pneumatic repair needs. Want to join the conversation? Like and follow us on Facebook!